Using income as a company director in your partner visa application

In this post we consider how you can rely on income in your visa application as a company director/employee of a business where you have a shareholding.

This can be your income (you, the person applying) if you are already in the UK as a company director/employee with the shareholding, or (more often) your partner’s income if they are.

This is a sub post of our full guide on How to apply for a partner visa, which has further information on the partner visa application process and the minimum income requirement.

In this post we look at the key rules, and provide examples of documents we have submitted in applications in the past to meet the evidential requirements. It is intended to provide general background on the relevant issues. These rules can be complex, and the requirements of the route will vary from application to application.

Whilst we have done our best to ensure that the information here is accurate at the time of writing, the UK immigration rules change frequently, so you should always check the position at the time you make your application.

This post was written by Nick Nason, director of Edgewater Legal. Book in a free initial call with Nick if you want to discuss getting help with your application, or would like to explore what getting help looks like.

Director income: overview

To apply for a partner visa you need to show that you meet a minimum income requirement.

The level of the requirement depends on the date of your first application in the route: see our main post for the applicable threshold in your application.

It is possible to meet the minimum income requirement by relying on salary received from your sponsor’s employment (or your employment if you’re lawfully in the UK) and/or from dividends.

However, if the source of the salary or dividends is a 'specified' company, then special rules will apply in terms of the evidence you will need to provide with your partner visa application.

What is a 'specified' company?

If you are relying on salary/dividends from a company as 'specified' by the Home Office, you will need to provide the evidence listed further down below.

A company will be 'specified' if the person receiving the income

- is a director and/or employee of the company providing salary/dividends (or of another company within the same group); AND

- holds shares (directly or indirectly) in the company, or has a family member who holds shares; AND

- any remaining shares are held by fewer than 5 other persons

We see these rules most commonly where a partner/sponsor is paying themselves a monthly salary and/or dividends via an incorporated company (where they are sole director/shareholder), and you are relying on this to meet the income requirement in your visa application.

Note that the rules were changes in 2017 to also cover income received by employees (not just directors) of 'specified' companies.

For ease of reference, and because these rules most commonly refer to company directors, we will refer to directors in the rest of this post. But note that employees of specified companies are also covered by these rules.

How to calculate your income as a director

Where relying on the income received by a director of a specified limited company, this comprises the total salary and/or dividends received in the last full financial year, or an average of the last two full financial years.

The relevant financial year or years will be that covered by the Company Tax Return CT600 and corresponds to the 12-month accounting year of the company. This will usually be listed on Companies House in the following format:

In the example accounting year here (taken from a Companies House profile), you would only be able to rely on the salary and dividend payments received in the period 1 April 2023 – 31 March 2024.

Timing is everything

Immediately you can see the issue this causes if you have set up your business but have not yet completed your first full financial year: to rely on income in this route, you would need to have completed the company’s first financial year.

It can also be problematic if you are just starting out and not yet in a position to pay yourself significant amounts (or at all): dividends can only be paid out of profit of the company, and many companies are not profitable in the early years.

And you might be doing very well 9 months after the end of your last financial year, but the amount you can rely upon is fixed at the remuneration received in salary/dividends in that last financial year.

Case study

Sam is British (Sponsor) and is the sole director/shareholder of a specified limited company. He is based in the UK. He is sponsoring his wife, Andrea (Applicant), who is in the UK on a Graduate Visa, and is making her first application to switch into the partner route. Sam’s company’s financial year runs 1 January – 31 December. They are looking to apply on 1 June. When calculating Sam’s income for the purposes of the Minimum Income Requirement, it his income received during the period 1 January – 31 December of the most recently completed company year that will be counted for the purposes of the minimum requirement (or an average of the last two company years).

As you can see, if you are planning to apply on the basis of income received in this way, advanced planning is usually required.

Combining with other income/resources

It is sometimes possible combine your income as a director of a specified company with other ongoing sources of income received by you and/or your partner.

Director’s income and other salaried income

It may be possible to combine director’s income with income from salaried and non-salaried employment, non-employment income and pension income in order to meet the financial requirement.

However, there are two MAJOR caveats

- these other sources of income must fall within the relevant financial year(s) of the company tax year in order to be included; AND

- these other sources of income must still be a source of income at the time of application

This is best illustrated with our case study:

Case study

Whilst Andrea has been in the UK on her Graduate Visa, she has worked as a barista for a few years and she is still in employment on 1 June at the date of the application. However, only her salaried income from barista employment received during the period of Adam’s company’s financial year (1 January – 31 December) (i.e. in the 6-18 months prior to the application date) can be counted.

And if Andrea had lost her job as a barista by the time of the application, she would not be able to rely on this previous income. Andrea would need to provide evidence of her ongoing employment as a barista with the application.

Where combining income, full evidence of all sources needs to be provided (see below for more on evidence).

Director’s income and other self-employment income

It is theoretically possible to combine income received as a director via a company, and income received via self-employment.

However, the guidance makes clear that if a person (or their partner) has different financial years for their income as a director and their income as a self-employed person, they cannot be combined:

Case study

In addition to running his company as a director, Adam runs a side-hustle in a completely unrelated area, and which he doesn’t bill through his company, and for which he invoices separately on a self-employed basis. Because his company financial year is 1 January – 31 December, and his self-assessment tax year (6 April – 5 April) are different, he cannot include the side-hustle income in his calculation.

It is therefore important to bear these restrictions in mind when planning how you will meet the minimum income requirement.

Director’s income and cash savings

When considering other types of income, cash savings can be used to reduce the amount you need to show to meet the minimum income requirement.

However, cash savings cannot be combined with director income, and so cannot be used to reduce the income you need to show.

We have prepared a note on how cash savings interact with those other income options.

Directors of companies overseas

Where a person is either a director or employee (or both) of a limited company registered overseas, they cannot rely on the provisions for directors of specified limited companies in paragraph 9(a) to meet the financial requirement.

Instead, the director of a limited company registered overseas might be able to use their income towards the financial requirement if the income is of a type that qualifies as employment income or as non-employment income.

Director income: evidence

The amount of documentation you have to provide where you are relying on director income is substantial. We look here at what some of the documentation looks like.

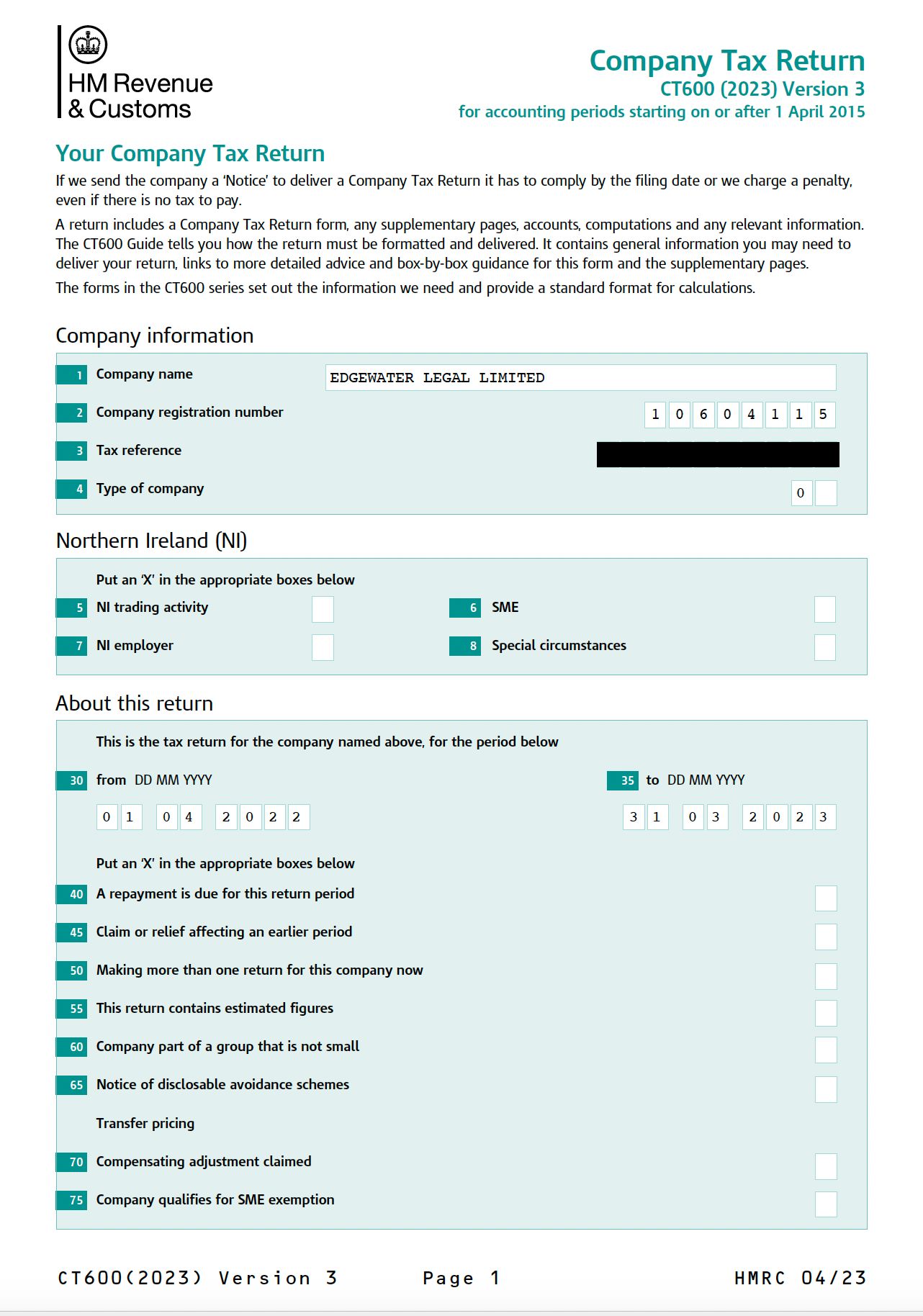

Company Tax Return CT600 for the last full financial year

This is what the first page of the CT600 looks like, but you would usually include the full return(s) of the year(s) relied upon:

You will see that it confirms on the first page the date of the relevant financial year.

As discussed above, this is key for determining the level of income you can rely upon in your application.

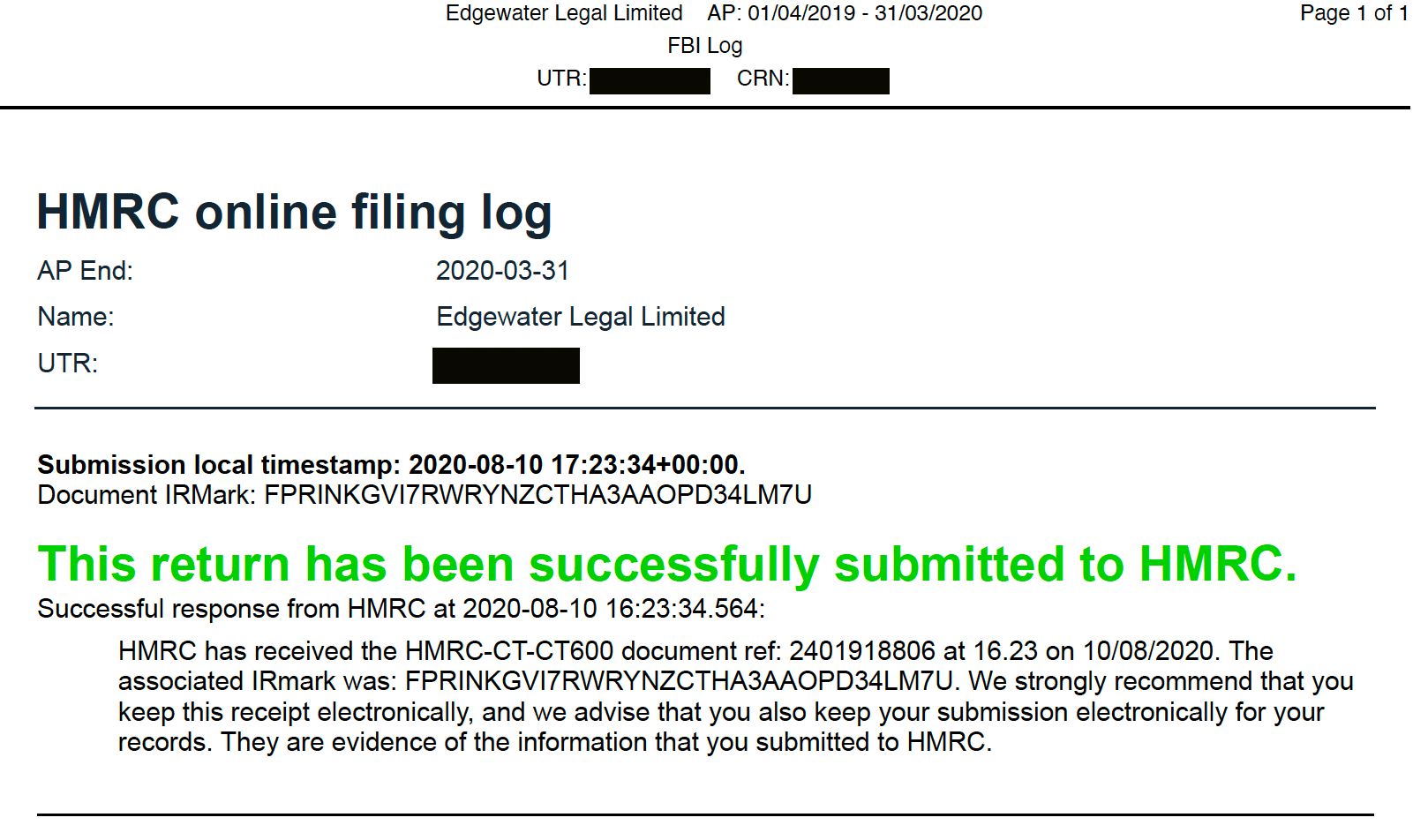

Evidence of CT600 filing

You need to confirm that the tax return has been filed with HMRC. This is an example of an electronic acknowledgment provided by HMRC:

As ever, these processes and procedures change at HMRC so you may not have one which looks like this.

Corporate/business bank statements

You should provide bank statements for the business covering the same 12-month period as Company Tax Return CT600.

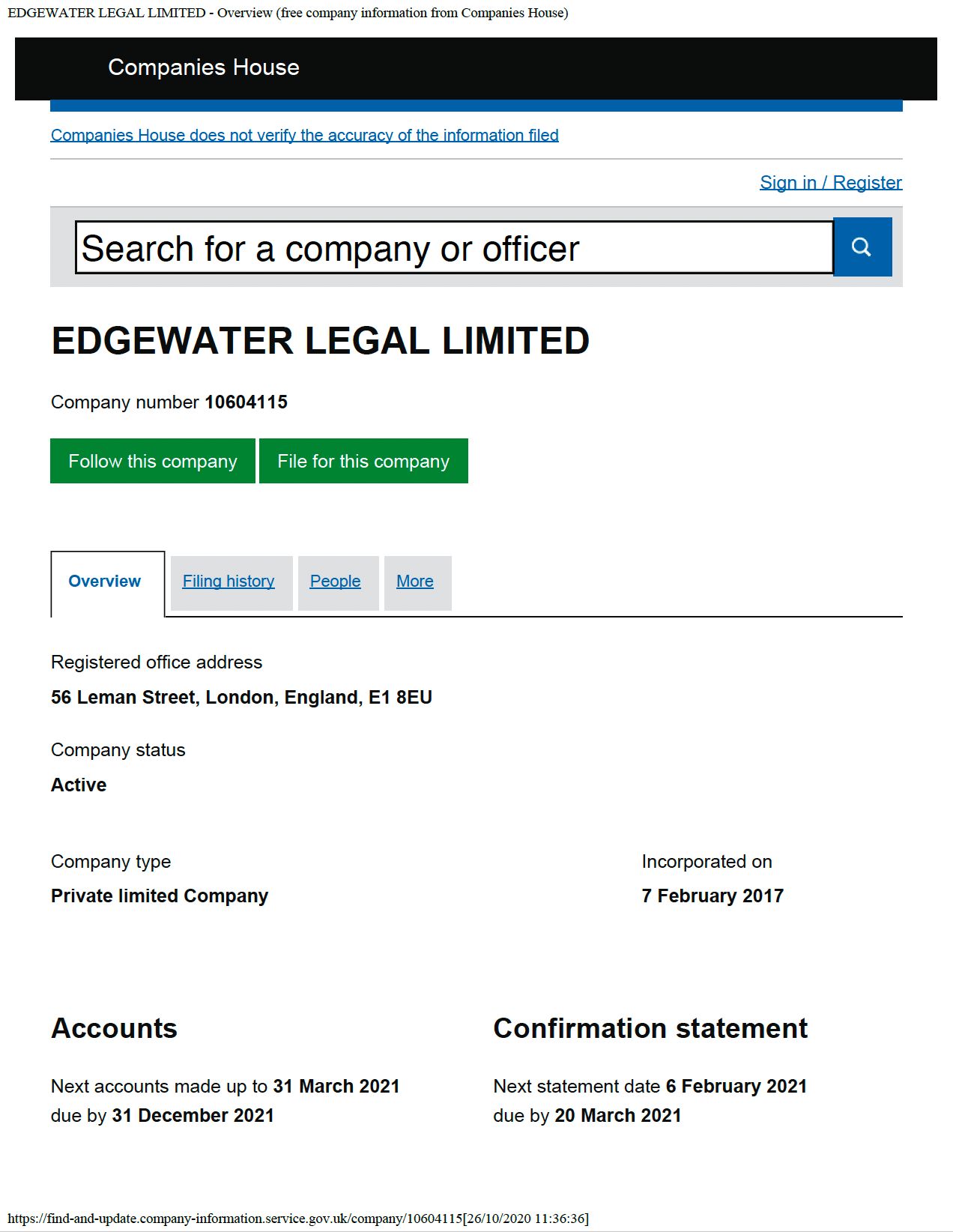

Registration at Companies House

Most companies should have a profile on the Companies House website. You can search for a company here.

Although the Home Office have access to the Companies House website like everyone else, they still ask for evidence of registration to be provided.

This is an example of the format of document that has been accepted in the past:

I would usually send this overview along with the current appointments page (showing you are a director), and the PDF of the filing history which is also on Companies House.

Audited or unaudited accounts

If the company is required to produce annual audited accounts, such accounts for the last full financial year should be provided.

If the company is not required to produce annual audited accounts, unaudited accounts for the last full financial year and an accountant’s certificate of confirmation should be included with the supporting documents.

The accountant needs to be of a type approved by the Home Office, and which are listed in the guidance.

One of VAT registration/evidence of business premises/PAYE registration

The rules require that one of the following be provided

- a certificate of VAT registration and the VAT return for the last full financial year if turnover is in excess of £79,000 or was in excess of the threshold which applied during the last full financial year

- proof of ownership or lease of business premises

- original proof of registration with HMRC as an employer for the purposes of PAYE and National Insurance, proof of PAYE reference number and Accounts Office reference number - this evidence may be in the form of a certified copy of the documentation issued by HMRC

One imagines there are a significant number of businesses – e.g. a person working from home without employees, below the VAT threshold – which may struggle to provide these documents.

VAT registration and return

The VAT certificate is usually downloadable from the HMRC portal, and has previously been sent out by hard copy letter.

If you are providing the VAT certificate, then the returns should also be provided.

Proof of ownership/lease of business premises

If you are renting or own your business premises then you should provide proof of this. If you are renting your premises then this would usually be in the form of a lease with the premises owner or their agent.

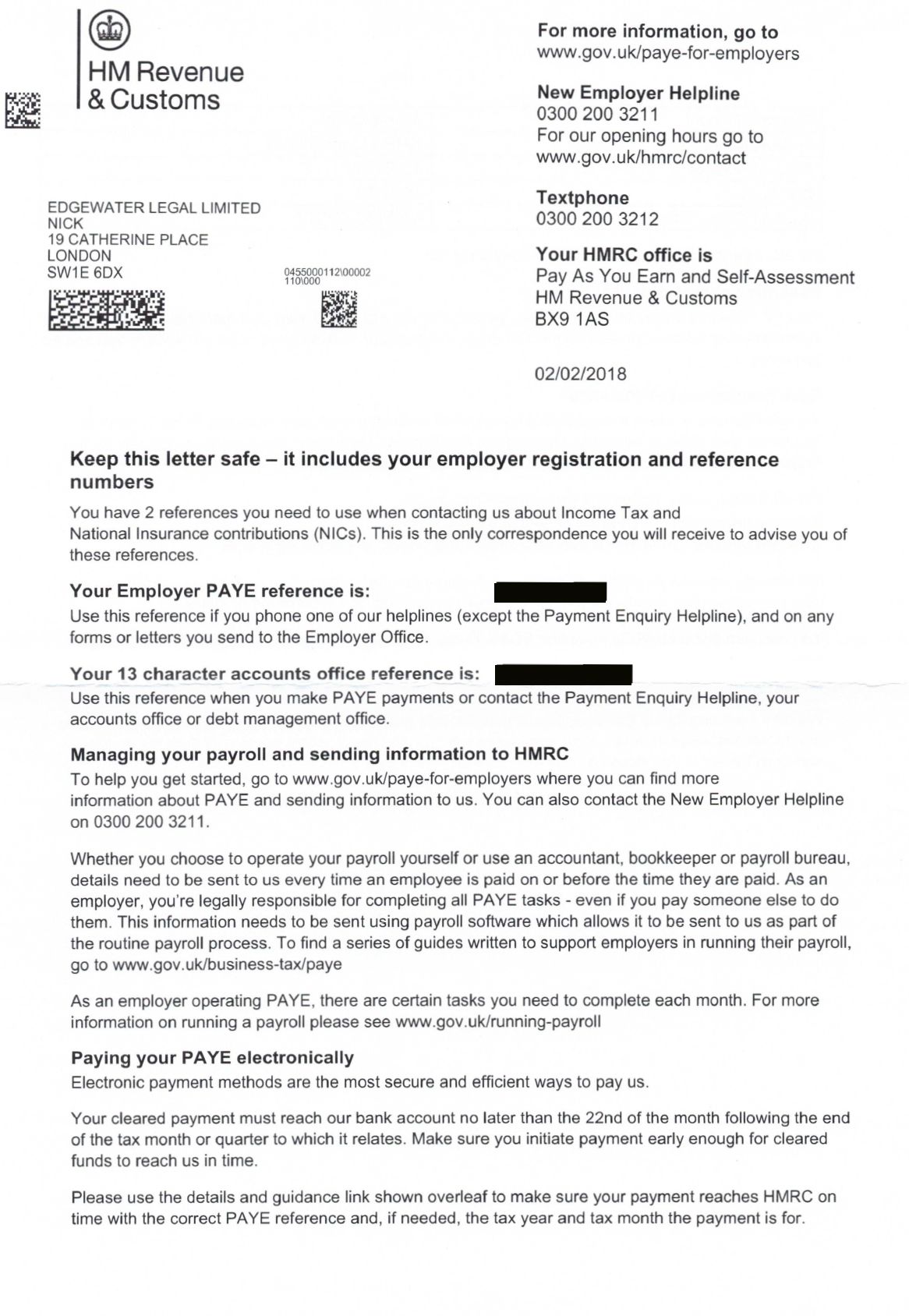

PAYE registration

When you employ workers you are required to register with HMRC in order to deduct tax at source. The letter that HMRC used to send out looks like this:

Note that these rules have not been substantially updated since they were written in April 2013. There continue to be references to sending ‘original’ documents, or certified copies of documents.

However, in our experience, scans of these documents – which is after all how all supporting documents are provided to the Home Office in the vast majority of immigration applications – are acceptable.

Documents confirming income during company tax year

You will need to provide documents which confirm income received during the relevant company tax year.

Payslips and P60 (if receiving salary)

Where salary has been received, you should provide payslips and P60 (if issued) covering the same period as the Company Tax Return CT600.

If salary has continued to be received since the end of the tax return period, then you should provide these.

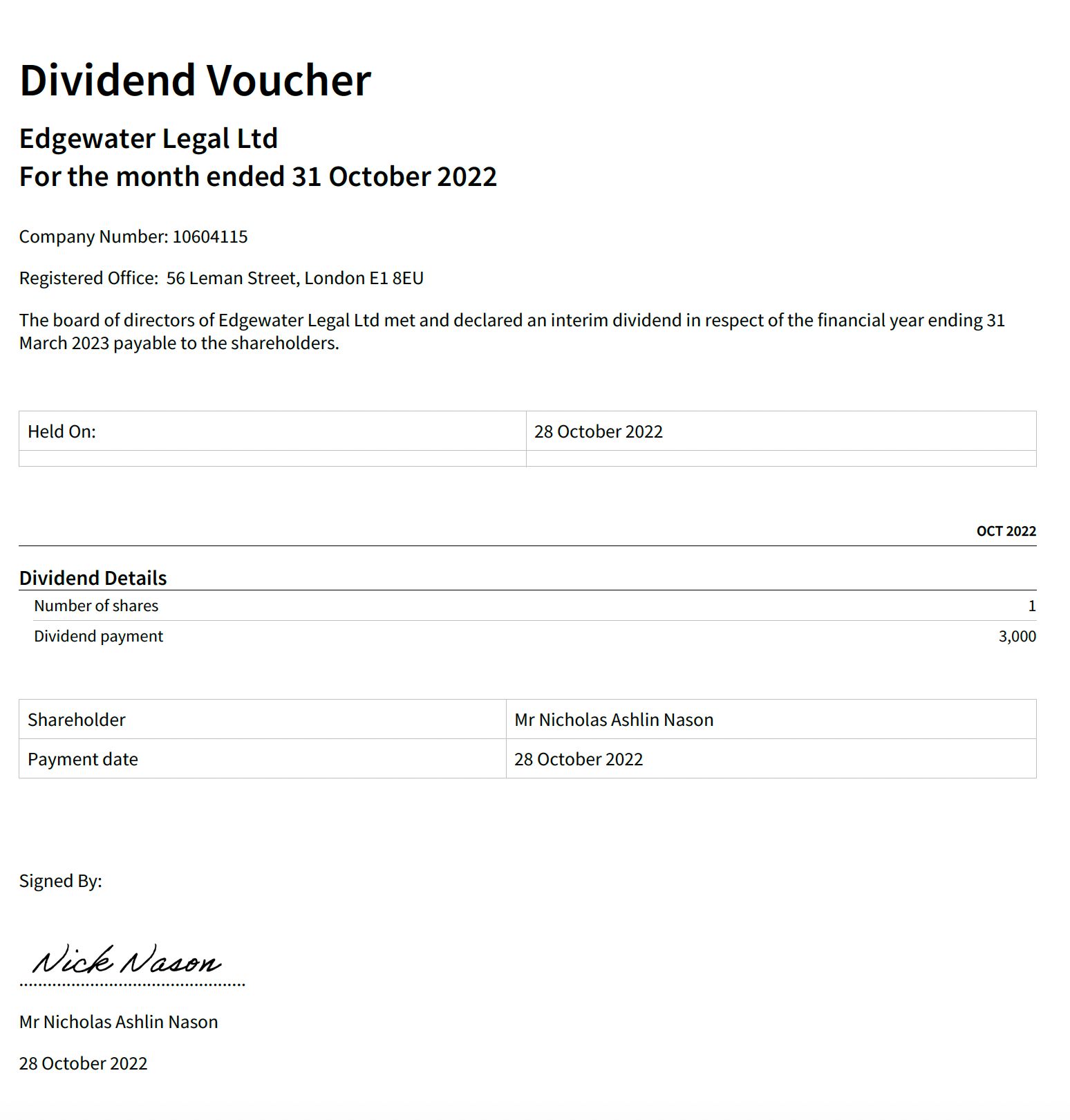

Dividend vouchers (if receiving dividends)

Dividend vouchers are like payslips but for dividends. This is an example of what one looks like:

Note that the guidance states that the dividend voucher should show the person’s net dividend amount and tax credit.

However, a person’s overall tax position (and therefore the gross/net split of the dividend) is not going to be known until the completion of the relevant tax year. As a dividend is (or can be) declared contemporaneously i.e. during the course of the tax year, it is difficult to see how this could be included.

Personal bank statements

The person earning as a director should provide bank statements covering the same 12-month period as the Company Tax Return CT600

These statements should show the salary or the dividends above were paid into the bank account or your joint account. I would usually highlight the relevant lines in the statements showing receipt of the payments received.

Documents confirming ongoing salary/dividend income/business activity

Finally, you have to provide evidence which confirms your ongoing employment as a director or of ongoing dividend income from the company in the time period between the end of the financial year and the date of your application.

If salary is still being received, you would provide all of the payslips since the end of the last financial year.

If dividends are still being received, you would provide all of the dividend vouchers since the end of the last financial year.

In either case, you would provide bank statements to show receipt of the relevant payslips/dividends.

If you had stopped paying either salary and/or dividends then alternative evidence of ongoing business engagement may include, the guidance suggests, evidence of ongoing payment of business rates, business-related insurance premiums or employer National Insurance contributions in relation to the company.

Remember that the purpose of this evidence is to show that the activity is ongoing: the amounts are less relevant, as the income received since the end of the tax return year won’t be included in the overall assessment.

This post is intended to provide general background on the relevant issues and does not constitute legal advice. The law (and fee rates) may have changed since the date this article was published. You should always take legal advice relating to your individual circumstances.